Yesterday, ICICI Bank launched a facility which will enable its account holders to transfer funds easily via Twitter. So, we decided to test it to see if it’s really worth the hype. At the end of it, we were left satisfied as it is making banking simpler for the account holders.

The process is quite simple. You just need an ICICI Bank account and a twitter handle to get started.

After following ICICI bank’s twitter handle, users need to send a direct message to ICICI Bank with the format #reg to register. After doing this, you will immediately receive a message on your phone containing the one time registeration pin (OTP) for the same. After sending a message with the received OTP in the following format : #regotp you are all set to go.

After following ICICI bank’s twitter handle, users need to send a direct message to ICICI Bank with the format #reg to register. After doing this, you will immediately receive a message on your phone containing the one time registeration pin (OTP) for the same. After sending a message with the received OTP in the following format : #regotp you are all set to go.

In addition to transferring funds, account holders can also do the following:

- Check account balance by sending #ibal as a Direct Message to @icicibank.

- Check last three transactions by messaging #itran to @icicibank.

- Recharge any prepaid mobile number with a simple Direct Message in the following format: #topup.

However, we’ll test out its facility of transferring funds since the above facilities are also provided by the ICICI Bank application. For funds to be transferred, the beneficiary must also have a twitter account. The beneficiary can have their account in any bank for the transaction to take place.

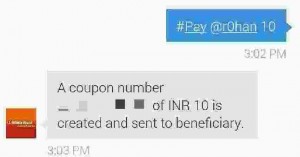

To start off, the person willing to transfer funds sends a Direct Message to ICICI bank in the following format: #Pay <Receiver’s Twitter handle> .

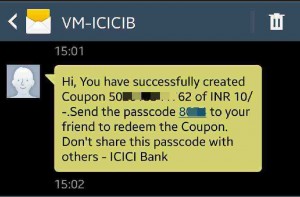

Upon sending the DM, the ICICI A/c holder will receive an OTP for the transaction which must be shared with the beneficiary.

The beneficiary will receive a DM from @bankdemo twitter handle containing the link to be visited to redeem the voucher. It must be noted that we were surprised by the message from @bankdemo which provided no description and gave a shady appearance.

Upon clicking the link, the beneficiary is taken to ICICI bank’s site where he is asked to verify his twitter account.

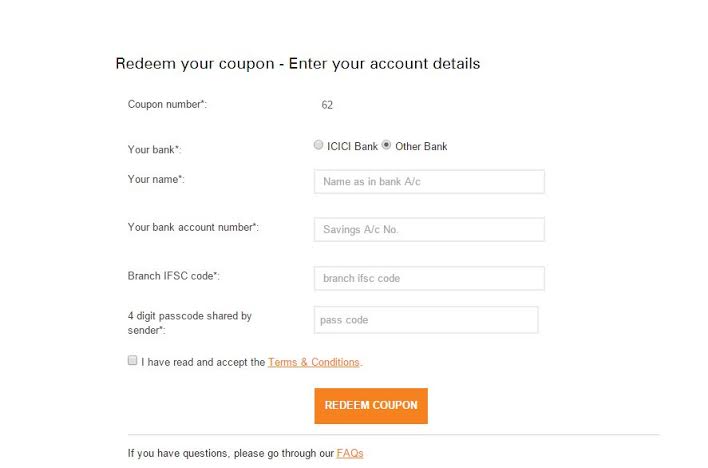

After verifying the Twitter Account, the beneficiary is asked to provide their name, bank account number and OTP which the sender had shared with them.

After verifying the Twitter Account, the beneficiary is asked to provide their name, bank account number and OTP which the sender had shared with them.

Also, the page may ask for beneficiary’s IFSC code if they don’t have an account with ICICI. After entering all the details, the transaction can be completed by just clicking on the submit button. The beneficiaries are presented with a message saying that the transaction will be completed in a working day which is pretty standard for such transactions.

ICICI is using the NEFT (National Electronic Funds Transfer) or RTGS (Real Time Gross Settlement) for the transfer and will not charge for such fund transfers but the sender will have to pay the fees as applicable for a NEFT or RTGS transaction.

After, completing three transactions successfully we felt that the twitter transfer service worked smoothly. It saves the hassle of adding a beneficiary each time a transaction needs to be done. All you need is a twitter handle for it to work! Also, it saves a lot of time as there are no time limits unlike other electronic transfer methods. The sender does not need to know account details of the beneficiary which is also an added advantage. Users can also easily opt out of the service by just unfollowing @icicibank.

However, we had some second thoughts about this facility. Even though ICICI states that it follows a two- step authentication process we are scared to imagine our phone falling into the hands of a “tech savvy” thief. However, don’t be too afraid if your twitter handle gets hacked, since the OTP is sent each time for a new transaction on your phone. Also, ICICI has set the maximum limit at Rs. 10,000 which limits the liability in case your phone gets stolen.

With every new service there are undoubtedly some apprehensions among the masses. But the – Twitter Banking provided by ICICI is quite revolutionary in terms of the simplicity and ease. It must be praised as a thoroughly thought step which aims to simplify banking for the consumer.