Google is about to complete its $12.50 billion acquisition of Motorola Mobility, the handset manufacturing arm of Motorola. For now the acquisition is being projected as a move to fend off the patent wars and interestingly being appreciated by manufacturers like HTC, Samsung, LG and others. But with Google’s acquisition of Motorola it has become a direct competitor of the same manufacturers, no matter how Google spins it. So how will it affect the smartphone industry? Here, is what we think…

It wasn’t exactly the hardware the search giant was after. It was rather the 17,000 patents and an additional 7,500 patents under review that prompted Google to gobble up the loss making firm which recorded a loss of around $89 million in the last quarter. Also, the fact that the acquisition of Motorola allows Google to own all the three i.e. software, hardware and services and hence allows them to seamlessly integrate all of them to produce better innovative products and hence puts them in an even better position to compete with the integrated iOS experience from Apple.

And one thing we have to admit is that no firm in the history of tech has been able to separate its software and hardware companies. Palm’s unsuccessful attempt to disintegrate itself into software and hardware firms was an epic failure which serves as the best example for resisting any temptations by Google to follow suit.

After buying Motorola for a premium of about 63% above its market value, do we expect Google to let Motorola Mobility function as a separate entity and incur losses? Google would definitely want to push Motorola’s Android handsets in the market and had it not been for the open ecosystem around Android, perhaps by sending exclusive OS upgrades to Motorola. Google favored Motorola to release their Honeycomb OS on the Xoom tablet so now there is all the more reason to grant them the priority status. If we aren’t wrong, Honeycomb isn’t opened sourcedyet

Given Google’s inexperience with hardware business, keeping in mind the blunder they committed with the Nexus One by selling it only online wherein users are accustomed to buying handsets via carriers; it will be interesting to see who controls and leads the hardware business, Google or Motorola.

So for now though Google Android Chief, Andy Rubin maintains that Android will remain open, no manufacturer would like to indirectly promote its direct rival i.e. Motorola. And thus by now I’m sure most of them are toying with the idea of forging a new partnership with another platform.

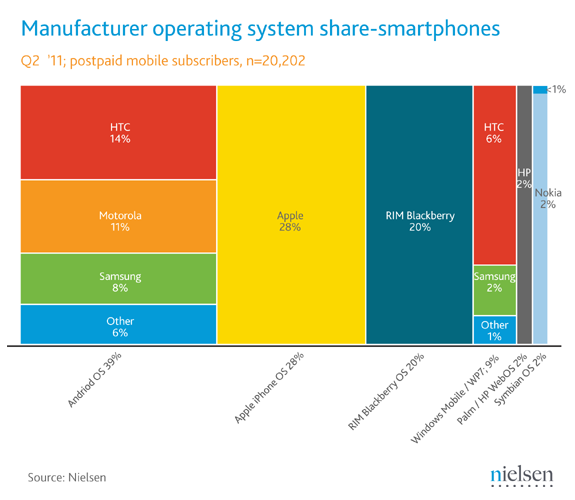

HTC commands a solid 14% of the total Android’s 39% share of the smartphone market and hence it is a vital cog of the Android ecosystem. But considering the fact that they are the small fish in the big Android pond and manufacturing smart phones is their only line of business makes them more vulnerable to the effects of the Google – Motorola deal. And this is why they are all the more likely to consider a switch or even ink a deal with another platform to hedge their risks. This is where Microsoft comes into the picture.

HTC originally started off with Windows mobile and they still have the HTC HD7 and HTC Trophy amongst others running on Windows Phone 7. Microsoft is a pure software player in smartphone arena, one of the strongest players when it comes to intellectual property, and commands a stake in Facebook + owns Skype. Put these pieces together and Windows Phone 7 becomes a lucrative choice not only for HTC but for other manufacturers as well.

And we are not just talking about the positioning of WP7 / Microsoft, having seen Windows Phone 7 since it came out last year and even looking at the Mango update (beta) that Microsoft is about to roll-out, we are clear that WP7 has potential. It has a blend of good UI and functionality. It may have some distance to go with apps and performance, but Android isn’t that far ahead for manufactures to ignore Windows Phone 7.

Currently there are only two other platforms in the market that are worth considering. One is the WebOS which is now owned by HP and it looks highly unlikely for any of the major players opting for the webOS platform after the dismal performance of the HP TouchPad, Pre Series and Veer in the market and the resultant killing of webOS by HP. Another issue with WebOS is the fact that no other mobile player has the cash to buyout WebOS from HP and develop it aggressively against Apple, Microsoft and Google. And the other is RIM’s QNX platform which RIM itself is struggling to move onto and revive their own smartphone business.

Hence I would rule both of them out. And this makes the way clear for Microsoft’s Windows Phone 7 to forge partnerships and make rapid gains in the smartphone market.

Talking to a product head from one of the local mobile players in India, we could clearly see the optimism about Windows Phone 7. The well placed executive had no doubts on the fact that Nokia has a winner with Windows Phone 7. He pointed that for an end user, currently on a feature phone or a Symbian, Windows Phone 7 is a much simpler UI to begin with. And couldn’t agree more.

Microsoft buying HTC has been suggested, but that makes little sense to us. HTC is deep into Android and flirts with WP7 and it has made its own move spending $300 million on Beats music. Clearly, HTC would remain an independent player, juggling multiple operating systems. Besides Microsoft buying HTC would negatively impact billions of commitment Redmond has made to Nokia. And if you are saying Microsoft may buy Nokia, then our answer is NO, they would have already done that if they were any interested in vertical integration. For now, Android’s rocky patent battle and Motorola buyout coupled with HP’s failure with WebOS leads us to believe that Microsoft has a shot for the second spot.

Image Courtesy: Johnnie Maneiro