In what is largely seen as a regressive change to PayPal India’s terms and conditions, the company, starting March 1, 2011 would NOT allow its Indian users to make purchases for goods and services directly from their PayPal accounts. If that wasn’t all, users would have to transfer payments received to their accounts to their respective banks within 7 days of the receipt of the money. So what’s the worst part? You cannot receive more than $500 per transaction for your goods and services you offer – which is seriously lame. If you happen to be a Freelancer, this ain’t particularly heartening news for you, is it?

Here’s what the official announcement mockingly tells you:

“With effect from 1 March 2011, you are required to comply with the requirements set out in the notification of the Reserve Bank of India governing the processing and settlement of export-related receipts facilitated by online payment gateways

In order to comply with the RBI Guidelines, our user agreement in India will be amended for the following services as follows:

Any balance in and all future payments into your PayPal account may not be used to buy goods or services and must be transferred to your bank account in India within 7 days from the receipt of confirmation from the buyer in respect of the goods or services; and

Export-related payments for goods and services into your PayPal account may not exceed US$500 per transaction.”

This will undoubtedly affect people who are dependent on PayPal for services they offer to foreign clients.

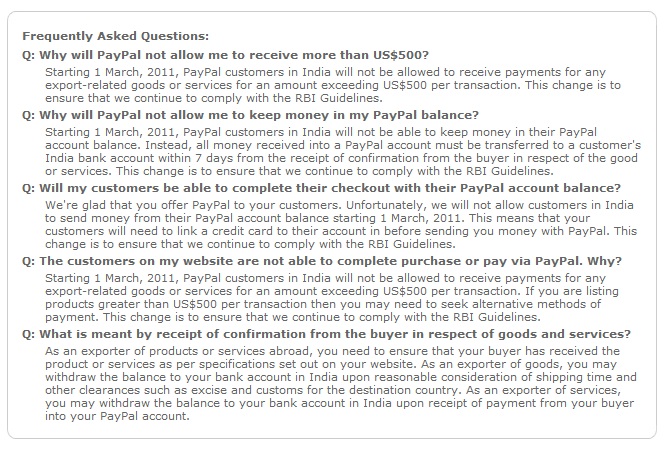

Paypal has also put up an FAQ that blames the RBI for this fiasco:

Seriously PayPal, its time you and RBI sit together, have a cup of coffee and decide whether to go back to 1995 or move ahead with the times.

*Googles “PayPal Alternatives”*

RBI has screwed all the 1,70,000 small techie businesses as now you cannot pay any small bills like

Domain Name Registration

Web hosting

Commission or incentives to other partners all over world

Small software’s or tools you buy

Small payments you make to run business

All this would never be possible now

RBI & Indian Govt does not want black money back they want 1,70,000 companies or individuals to shut or close there business. This will lead to atleast a job loss of 4-5 lac people in India

This would lead to a estimated loss of 2-3 billion dollars in IT field.

Shame Indian Govt Shame RBI

We should all put pressure or else we will have to perish.

RBI is playing the dirty game. Govt. is always behind the common man. They cannot stop the black money of the corrupt politician. They cannot control the increase in price rise. They can only squeeze Amm Admi. The RBI policy makers are always blind for ordinary people.

Throughout the world, people are using PayPal. We Indians cannot. Hundreds of housewives, retired man and young entrepreneurs were using PayPal to earn their bread.

Now, we cannot purchase even low priced ($10) software, eBbook etc from internet. What a shame !!

Don’t live like that put your opinion/complain at: http://www.rbi.org.in/scripts/helpdesk.aspx

PayPal, ebay.in has long ignored advice from merchants that they are not following RBI guidelines. For years they did illegal work and now we blame the RBI. Jai Ho

PayPal continues to violate India law.

Certificates of Authorisation issued by the Reserve Bank of India under the Payment and Settlement Systems Act, 2007 for Setting up and Operating Payment System in India

http://rbi.org.in/scripts/PublicationsView.aspx?id=12043

See PayPal listed? Nope, PayPal is missing. Those companies on the list, American Express, MasterCard, Visa, etal, have complained to the RBI about PayPal’s illegally operating in India.

When PayPal gets it’s act together, and applies for the Certificate of Authorisation, things will get back to normal.