If you are in the constant habit of topping up your phone over the internet, chances are you must have used PayTm or at least heard of it. Last year, PayTm launched its digital wallet service, PayTm wallet in India. It allows the user to transfer money from his credit/ debit card to the PayTm wallet which then can be easily used to top up mobiles, pay bills or to shop at the PayTm store. PayTm also announces cash back schemes regularly on recharges and purchases which can only be availed through the PayTm wallet. PayTm also announced a tie up with Uber for payment services and payments can now be made by integrating your PayTm wallet with the Uber app. It has also tied up with Microsoft for the latest Lumia phones to provide cashback of Rs. 750 upon installing PayTm Wallet.

Now, the digital wallet provider PayTm is planning to set up almost 50,000 retail stores where its customers can conveniently load physical cash to their digital wallet. The company is also willing to enlist retailers like local grocery stores as merchants for accepting digital payments. Further, to encourage users to do transactions through their PayTm wallets, the company has linked its PayTm Wallet to the banks to enable cash withdrawals from it. The company has also applied for a payment banking permit. This will enable customers to do Paytm Wallet to Bank transfers whereas only wallet to wallet payments are possible right now. PayTm has a user base of almost 2.4 crore in India.

“For India to move from a cash economy to a cashless one, we need to have a number of places where cash can be converted into electronic form”- Amit Lakhotia, VP-payments at Paytm

This move to digitize money transfers is a very positive step forward and we feel that it is in line with the current government’s vision of moving India towards a digital economy. Although, digital money is not a new concept and services like Airtel money, m-pesa were always present in the Indian market, these services did not gain enough traction in the market due to the limited functionality and no proper integration with banking services. Other wallet service providers in the country are Oxigen and Mobikwick . PayTm Wallet aims to overcome these handicaps through its comprehensive online store which boasts of a large collection of items users can purchase anything by using Netbanking or PayTm Wallet just like any other e-commerce store. The Wallet can also be used on a number of service providers like BookMyShow, Redbus, ShopClues to name a few.

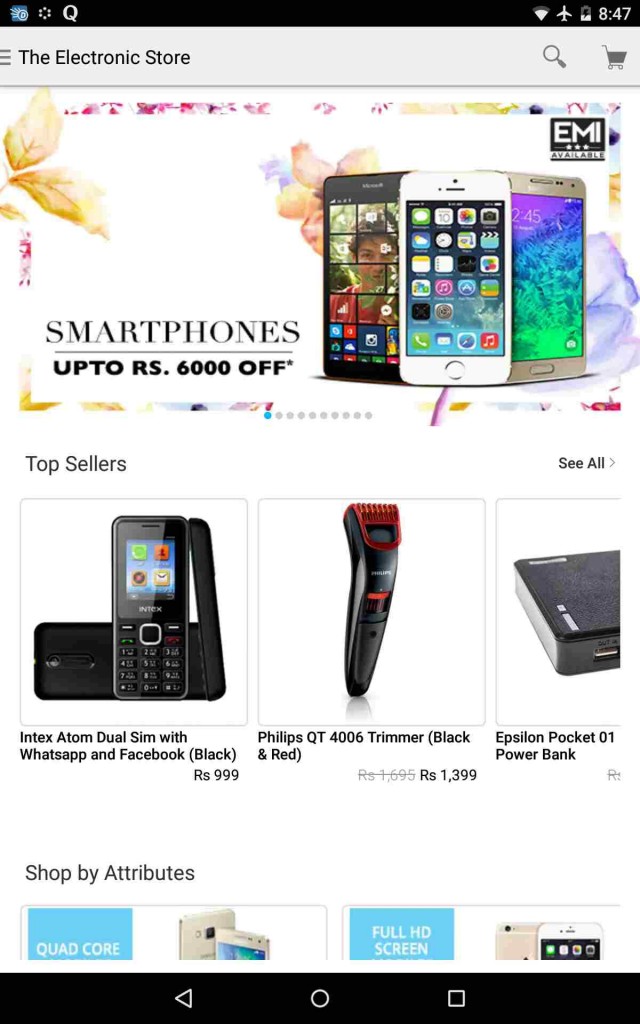

Screenshot of the current PayTm Store