India is rapidly opening up to technology like never before. While events like demonetisation are big moves that accelerated the cashless economy, the government has been working tirelessly to enable many APIs that are critical for digital India. Some of these initiatives are referred to as India Stack. This includes AADHAR, UPI (payments infra), eKYC amongst others. A part of this digitisation of important governance functions is the GST rollout in India. GST in India would enable API driven filings & compliance in a never before seen way.

GST is all set to replace multiple indirect taxes in the country such as VAT, CST, ST, etc. It also replaces the age-old disconnected filing of these taxes and provides a technology to centralise invoice information. This will allow seamless flow to avail input tax credit. In order to claim input tax credit on purchases, taxpayers will have to upload line-level detail of their invoices.

At scale, we are talking about 70 lakh+ taxpayers uploading details of close to 3 crore B2B invoices every month which will generate approximately 20 petabytes of data!

Let us see how the Government has built the architecture to support this mammoth scale.

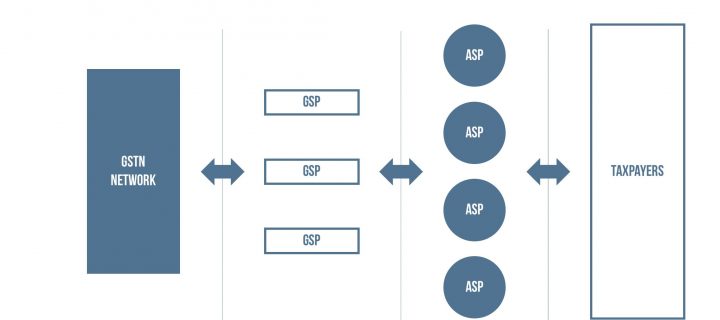

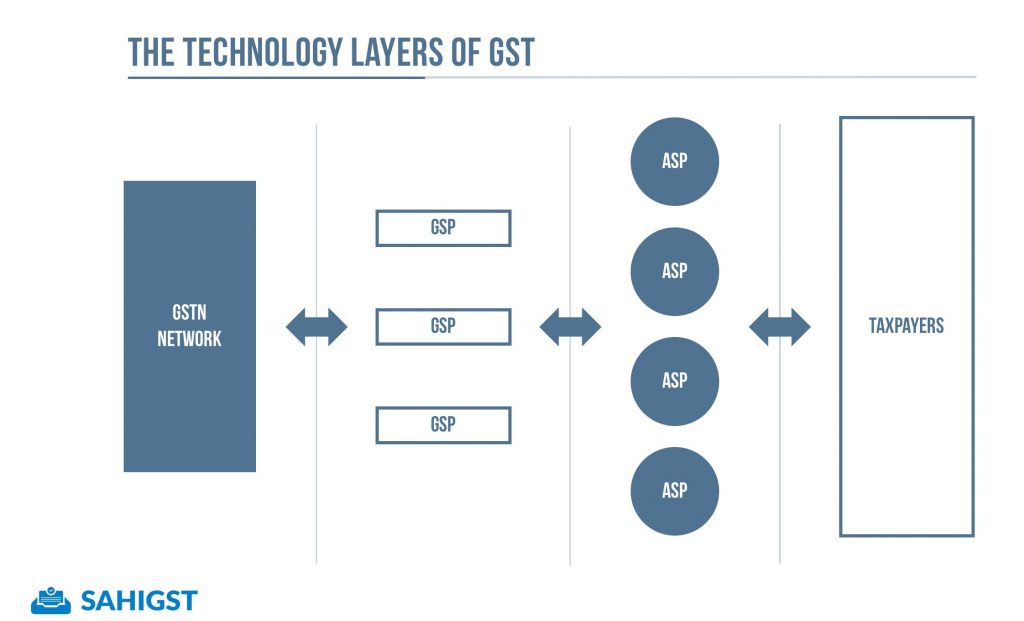

At its core is the GSTN network where all filings and issue of refunds will take place. This is a public-private partnership (PPP) where 51% stake is owned by non-government financial institutions. 24.5% stake of GSTN is owned by Government of India and remaining 24.5% by Empowered committee of all state finance ministers. Headed by Mr. Prakash Kumar, ex-Microsoft, an IITian, the GSTN has been working on developing the ecosystem for the GST rollout. In the meanwhile, Infosys is getting the technology network, a Rs. 1,380 crore contract. Taxpayers will do their GST filings with GSTN with the help of ASPs (Application Service Providers) via the GSPs (GST Suvidha Providers). Too many acronyms? Let’s sort them out one by one.

ASPs will provide taxpayers an interface to enter their invoice details and make the filing with the GSTN. However, these filings are routed by GSPs to ensure all load doesn’t fall with the GSTN on deadlines. Quoting from GSTN website – “The GSPs are envisaged to provide innovative and convenient methods to taxpayers and other stakeholders in interacting with the GST Systems from registration of entity to uploading of invoice details to filing of returns.” There are a total of 33 GSPs finalised by the GSTN till date. ASPs (that’ll be a lot in number) need to partner with GSPs in order to communicate with GSTN.

GSTN is providing APIs for the GSPs/ASPs to communicate with the system. That’s a first and we will see cloud-based solution for GST compliance coming up rather than the old desktop CD based solutions. For the first time there’s an opportunity for application makers to innovate and reduce this headache of GST compliance for taxpayers.

The technology is still evolving at all ends – GSTN, GSPs and ASPs. Everybody is waiting for the GST laws to be passed and make their final system GST compliant. In the meanwhile, let us know your view on whether GoI will be able to provide a system that runs without hiccups at scale?