UPI has taken the payments industry in India by storm. UPI has generated a lot of momentum within a few months, partly thanks to BHIM App that is promoted by PM Narendra Modi. The Ken today reports that WhatsApp is preparing to launch UPI powered P2P payments in India. This is in line with what I have heard a few weeks back from the folks involved in this process.

Unlike wallets where a consumer has her balance stuck within a particular app, UPI allows transactions across bank accounts. Banks being the default destination for consumers to park their non-cash balance, is more natural to use for P2P payments than a wallet.

This could be a big deal!

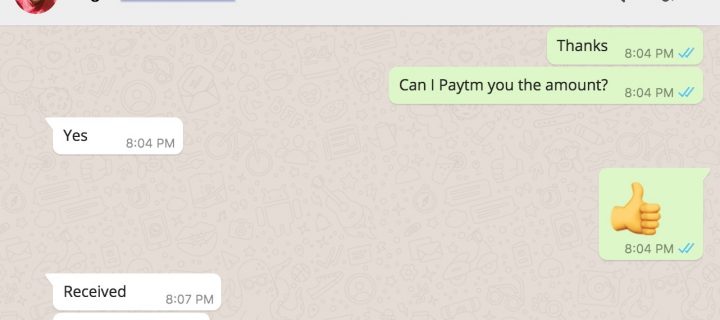

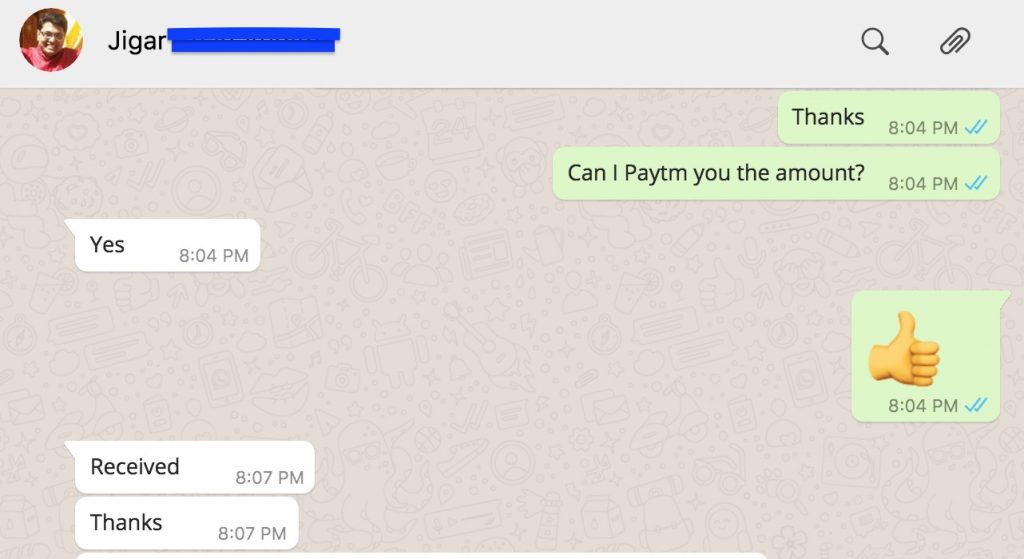

Whatsapp with 100M users in India, would easily become a dominant player in this space. Sending money to a friend can’t get more convenient than a Whastapp message. If you aren’t able to visualise how this can work, here is a screenshot from a real conversation I had last evening.

Now imagine this same flow of transferring a small amount being completed without having to leave Whatsapp! And without having to enter any CVV or Verified by Visa questions or loading the money on PayTM Via HDFC after a OTP verification.

UPI requires an one time configuring of your bank account wherein you set a PIN to authorise transactions each time. Users can request money from each other under the UPI protocol and the system has largely worked without hiccups.

We aren’t 100% sure how Whatsapp’s final interface under UPI would work and what kind of tie-ups would make that happen for them. But it is safe to assume that their attempt would be to make payments a part of the chat interface. Whatsapp has seen immense success with its voice and video services in recent times and they seem to have their eyes set on payments now.

It is also interesting to note that Whatsapp’s business head Neeraj Arora is on the board of India’s largest wallet provider Paytm.